This notion coupled with the increasing number of mobile tools that are available to support businesses provides an opportunity for streamlining the tasks associated with handling cash flows. In order to help with this process, Accounts Receivable Software developed by ezyCollect is a mobile app which automates many of the manual cash collection tasks to save time, money, and stress.

With any organization, as it grows and gains new business, managing all of the sales that have been made can be a tedious and stressful task. One of the most difficult and riskiest aspects of this is collecting from clients who initially paid with credit. During the actual collection process, managing who has paid what amount and what is still outstanding can take a significant amount of resources away from focusing on the business and products itself. With Accounts Receivable Software, several tasks are automated to alleviate the burden to include sending and managing outstanding amounts, handling claims that have been disputed, and recording conversations with the clients. Through the automation of these tasks, the app ultimately decreases the risk of not getting paid while simultaneously increasing inbound cash flows.[sc name=”quote” text=”Accounts Receivable Software is one of the highest recommended tools in order to improve cash flow management and reduce instances of missed payments”]

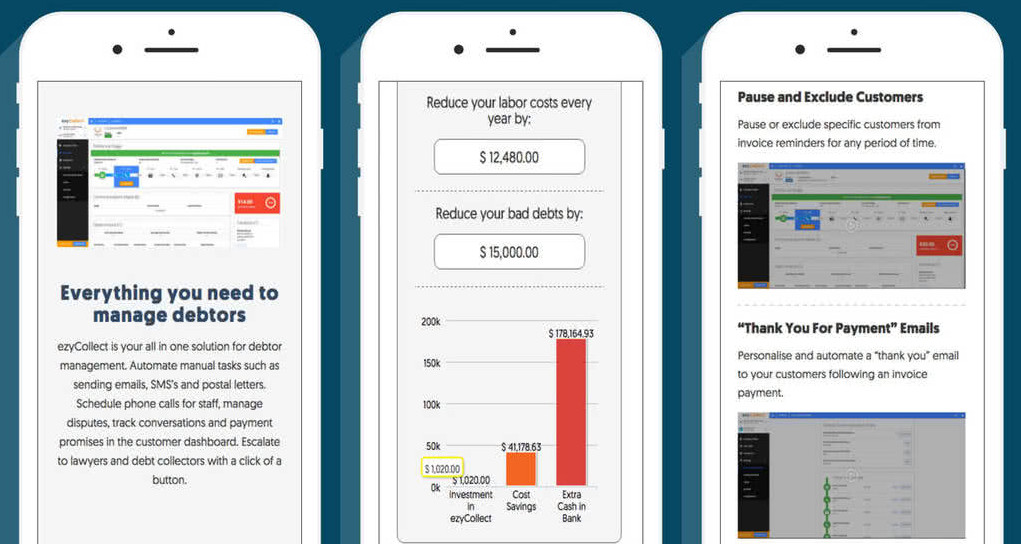

Extremely easy to use, even for those who are not business professionals by formal education, Accounts Receivable Software is designed in such a way that it is simple to grasp. The available tools are made highly accessible from initially opening the app to sending the first invoice for a customer. Furthermore, if a user is ever lost or has an issue, 24/7 support is offered through the app to ensure that there are no interruptions in the payments. One of the tools that draws users back to Accounts Receivable Software is the Return on Investment (ROI) calculator which is able to calculate how much money is saved when using the app compared to those who are not using it. Through this data, a powerful statement can be made regarding how effective it is in managing collections.

Although it automates many manual processes, setting up various accounts can be a difficult and time consuming task, especially for larger organizations with hundreds of existing clients. For example, if a company adopted this tool but had over 100 outstanding accounts, adding them individually to the app can be extremely tedious. However, once this initial barrier is overcome, the app requires nearly no input from the user to provide a tremendous amount of value to include automatically doing multiple follow ups via call, email, legal document, and then scheduling more personal communication events right into the calendar. Through all of these features, Accounts Receivable Software is one of the highest recommended tools in order to improve cash flow management and reduce instances of missed payments.